Overall Theme and Pre-Budget Expectations

If one were to summarize the theme of yesterday’s pre-budget expectations in two words, they would be: Smaller Government. It was expected that due to a lessening deficit, their majority status, and the fact that the next election is four years away, the Conservatives would use this budget to implement massive and sweeping cuts across all ministries and sectors, in order to drastically reduce the size of the government and public service. In advance of yesterday’s official budget release there were several items that were leaked early including: the raising of the Old Age Security threshold from 65 to 67 years; the restructuring of government contributions to public-sector pension programs; a reduction of the public service; the scaling back of parliamentary pensions; new spending in native education; and investment in science and technology. While it was clear in advance that this budget would focus on restructuring the economy for the future and implementing fiscally conservative principles Canada-wide, it was unclear as to what the extent of the cuts would be. As you will see in the budget highlights below, while there was much in the budget that will garner disdain from the opposition, many among the conservative faithful will conversely see it as a lost opportunity for greater austerity.

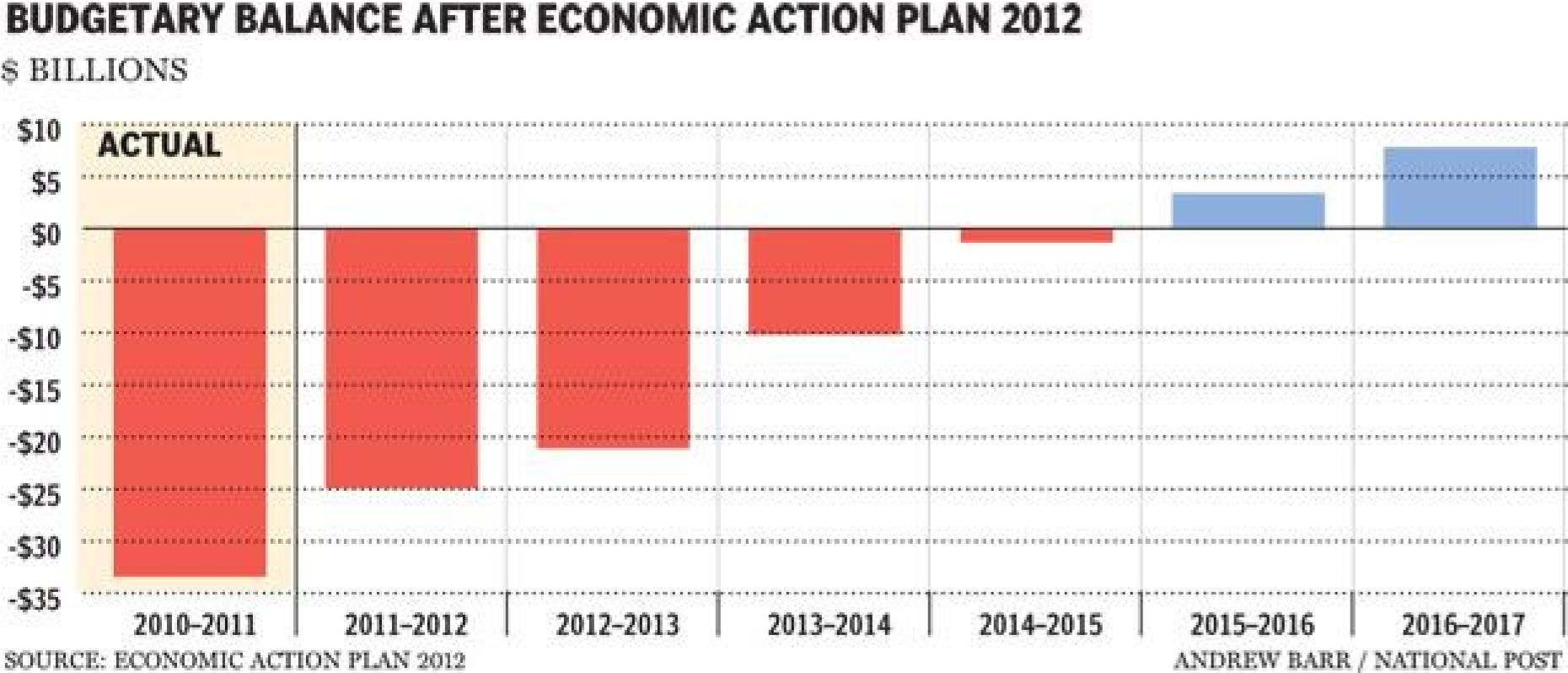

Federal Deficit and Surplus Projections (National Post, March 29 2012)

Titled “Jobs Growth and Long-Term Prosperity”, the

2012 Federal Budget is the first budget to be tabled under a Conservative majority in almost two decades. Having emerged from the global recession relatively unscathed compared to other G-8 countries, the Conservative government confirmed that barring anything unforeseen, the deficit will be eliminated by 2015. The budget’s overall theme focuses on the necessity for job creation, the continued elimination of inefficiencies and red-tape, and long term planning and restructuring to handle the expected burden placed on the system by future baby boomer retirees.

Budget Highlights

-

2011-12 deficit comes in at $25 billion, expected to be eliminated by 2015, with surplus predicted for 2016

-

Across the board cuts to all ministries leading to a savings of $5.2 billion a year by 2015, 70% of which will come from ongoing improvements to “operational efficiencies”

-

Planned cuts expected to result in elimination of 19,200 public service jobs over the next three years, 7,200 of which are expected to be eliminated through attrition

-

Gradual increase of eligibility for Old Age Security and Guaranteed Income Supplement from age 65 to 67 – starting in 2023

-

Changes to OAS will not affect anyone aged 54 or older as of March 31, 2012

-

Limit of one review with a firm timeline capped at 24 months for all major resource development projects

-

Cutting the budget of the CBC by 10% by 2014-15, totalling $115 million per year

-

Penny to be discontinued this fall, but will still hold value for spending

-

Public servants pension plan contributions to be adjusted so that employee contributions are shared equally with the employer (50/50 )

-

One-year extension of hiring credit to small business owners to encourage job creation

-

Governor General to begin paying income tax as of 2013

-

Removal of disincentives to taking work while on Employment Insurance, including cutting the current clawback rate in half, and applying it to all earnings made while on claim

-

$165 million to be invested over two years for “responsible resource development”

-

Retirement age for federal public servants rises to 65 from 60 for people hired in 2013

-

As part of First Nations Education Act, $275 million to build and renovate schools on reserve

-

Canadian Forces regular and reserve forces strength to remain the same

-

Katimavik program for youth will be eliminated

-

Government to sell or downsize some official residences abroad, and will implement longer service times to avoid relocation costs for foreign servants

-

More than $1 billion in investments in support of science and technology

-

Continued commitment to expand and initiate international free trade agreements

-

Planned revamp of immigration system, including improved recognition of foreign credentials

-

Limit increases to the Canadian Health Transfer to that of Canada’s nominal GDP as of 2017-18

Opposition Commentary

NDP

According to a release from leader Thomas Muclair, the NDP caucus has will oppose the budget unless it is amended to focus more on the priorities of Canadians, including strengthening front-line health services, fixing inequality, and increasing targeted incentives to create more jobs. He had the following to say regarding the budget:

-

Budget balances the books on the backs of seniors, forcing them to work longer

-

Unilateral changes to the funding formula for federal health transfers are unacceptable without further discussion with provinces

-

Does not provide the stable funding necessary to allow provinces to hire more doctors and nurses

Liberal Party of Canada

According to a release from leader Bob Rae, the Liberal caucus will oppose the budget, noting that it fails to make any real investments in job creation, and short-changes baby boomers and seniors. Regarding the budget, he made the following points:

-

Canada has experienced zero job growth over the past six months, but budget contains no real measures to grow jobs

-

Budget does not address youth unemployment or Canada’s skills shortage

-

Budget will worsen income inequality by increasing qualifying age for OAS

-

Fails to make tax credits refundable for caregivers, volunteer firefighters, children’s activities, and disability tax credit

-

Argues that the cuts to CBC, CIDA are ideological

Realities, Challenges, and Opportunities

By most accounts, this budget underwhelmed the expectations of both government critics and supporters alike. The deeper and wider cuts that opponents feared and fiscal conservatives had hoped for were toned down considerably in favour of a more balanced and less aggressive approach. In defense of this course, Finance Minister Jim Flaherty has argued that given the potential for continued economic instability in Europe and the U.S, Canada must be careful not to jeopardize its fiscal recovery with radical budgetary changes. While many saw this budget, Harper’s first in his majority four year term, as the perfect opportunity to introduce widespread cuts to eliminate the deficit, most agree that the economic conditions facing the country, while troubling, are not nearly as dire as what the Chretien Liberals faced in the mid 1990s. If the government is accurate in its predictions and the current $25B budgetary deficit is eliminated by 2015, Canada will remain one of the healthiest and strongest economies in the G20.

While the speed at which this Conservative government is moving has been criticized by many supporters and members of the media, there is no doubt that its long-term direction and style of governance is being clearly mapped out. By not increasing personal or corporate taxes, and by removing some of the regulatory red tape affecting businesses, the budget is essentially banking on achieving fiscal recovery through increased economic activity both by individuals and the business community. This budget supports the notion that Conservative governments are pro-business which should bode well for increased economic recovery over the short and medium-term, as well as providing incentive for businesses and stakeholders to engage this government on their issues as much as possible – before the onset of the 2015 election and their current four year term is up.